Cash books have two sides (left-hand side and right-hand side) where all receipts in cash are recorded on the left side, and all payments in cash are recorded on the right side. It should be noted that when the cashbook is used as a subsidiary ledger the discount column is still not part of the double entry. The column simply lists the discounts as with any other book of prime entry.

Double-Column Cash Book

- If a check is issued to a supplier, an entry is created in the bank column on the credit side of the cash book.

- Double column cash books will show things like bank transaction details.

- Triple column cash books will show all of the details from single and double column cash books plus some additional details.

- Transactions are recorded in a single column and the total amount of money received or paid out is updated at the end of each day.

- A financial professional will be in touch to help you shortly.

Ledger accounts are divided into two parts (the right-hand and left-hand side) to display information. Each cash book contains certain components relevant to identifying transactions and maintaining records. The cash books are opened in order to record all the transactions of money received and paid by a business concern on daily basis. Cash statements list all debits and credits for a specific period, such as a month or year. Some businesses maintain cash books instead of cash receipts journals and cash payments journals.

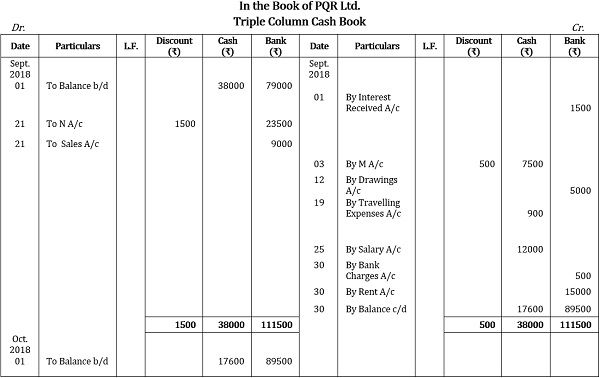

Step 6 – Calculating the Bank Balance Carried Down and Balance Brought Down

Goods purchased on credit from Sam, list price $ less 5% trade discount. The business received a further cash discount of 10% for prompt payment. All of this information is very important for accounting and tax records.

Is Cash Book a journal or a ledger?

The following transactions were performed by the company during the month of June 2018. The procedure of posting entries from a cash book to ledger accounts has been explained in single column cash book article. The same procedure is followed for posting entries from double as well as triple column cash book to ledger accounts. Although single and double column cash books are alternatives to a cash account, the a board member’s guide to nonprofit overhead serves the purpose of cash as well as a bank account. In general ledger, two separate accounts are maintained for discount allowed and discount received.

Bank charges are recorded on the credit side of the cash book in the bank column. This is because cash at bank decreases as a result of such charges. If you are ever recording entries in a three column cash book, this section presents a few key points you should bear in mind.

What is a bank statement?

The right hand, payments side (credit) would be identical in structure and format. From the following particulars write up the cash book of Rashid Khwaja Trading Co. for the month of October, 2016. Finally, in the usual manner, the receipt of cash is recorded in the cash column. The following transactions took place in the books of Samira during the month of January. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Sold merchandise to sweet Bros. for Rs 1,500 who paid by check which was deposited into bank. For the following transactions, you are required to describe side of cash book (Debit or Credit) and the column in which amount is entered (Cash, Bank or Discount). Discount allowed is an expense and discount received is an income of the business. Whenever it is necessary to determine the bank balance, the bank columns are summed on both sides. If a payment is made by cheque, it will be recorded on the credit side in the bank column. If the cheque is not deposited into a bank account on the same date, it is treated as cash and, therefore, the amount will appear in cash column.

If an entry is made on the debit side and the same entry is recorded on the credit side of the cash book, it is called a contra entry. When David writes out a check, he makes an entry on the credit side of his cash book (being a reduction in asset, cash at bank). If you are a business and you want to start using a bank cash book, you will need to speak with your bank. They will be able to provide you with the necessary forms and help you get started.

Every time cash, checks, money orders, or postal orders (or anything else) are deposited in the bank, the cash book (bank column) is debited. That’s to say, an entry is made in the bank column on the debit side of the cash book. The bank cash book is a type of cash book that is used to track the transactions between a business and its bank. Because the cash book is updated continuously, it will be in chronological order by transaction. In the description column, the accountant writes a short description or narration of the transaction.

Neueste Kommentare