Since the expense was incurred in December, it must be recorded in December regardless of whether it was paid or not. In this sense, the expense is accrued or shown as a liability in December until it is paid. Unearned revenues are also recorded because these consist of income received from customers, but no goods or services have been provided to them. In this sense, the company owes the customers a good or service and must record the liability in the current period until the goods or services are provided.

Introduction to Adjusting Journal Entries

Thismeans that every transaction with cash will be recorded at the timeof the exchange. We will not get to the adjusting entries and havecash paid or received which has not already been recorded. Ifaccountants find themselves in a situation where the cash accountmust be adjusted, the necessary adjustment to cash will be acorrecting entry and not anadjusting entry. An adjusting journal entry involves an income statement account (revenue or expense) along with a balance sheet account (asset or liability).

- Adjusting entries are the changes you make to these journal entries you’ve already made at the end of the accounting period.

- Without adjusting entries, financial statements may be misleading and inaccurate.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- The way you record depreciation on the books depends heavily on which depreciation method you use.

- However, that debit — or increase to — your Insurance Expense account overstated the actual amount of your insurance premium on an accrual basis by $1,200.

Create a Free Account and Ask Any Financial Question

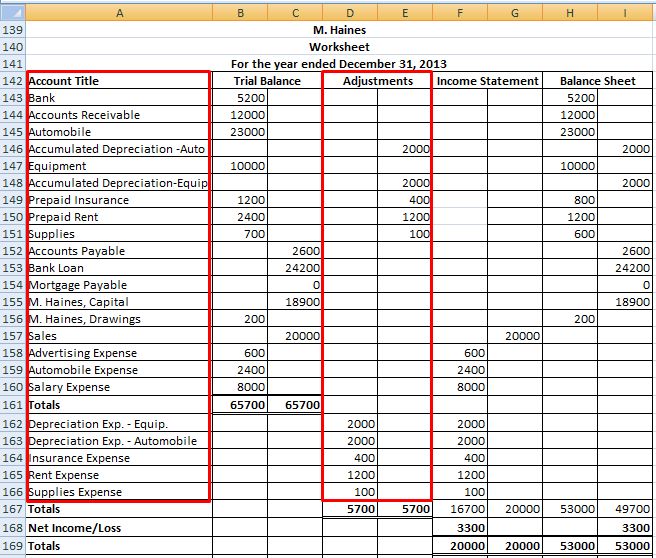

This can happen when estimates are not updated or when they are based on incorrect assumptions. To avoid this mistake, it is important to review and update estimates regularly. Now that all of Paul’s AJEs are made in his accounting system, he can record them on the accounting worksheet and prepare an adjusted trial balance. These adjustments are then made in journals and carried over to the account ledgers and accounting worksheet in the next accounting cycle step. If you do your own accounting, and you use the accrual system of accounting, you’ll need to make your own adjusting entries.

Accrued revenues

To put these revenues and expenses in the right period, an accountant will book adjusting journal entries. For this example, the accountant would record an equal amount of revenue for each of the six months to reflect that the revenue is earned over the whole period. The actual cash transaction would single vs double taxation still be tracked in the statement of cash flows. Adjusting entries are necessary to ensure that financial statements accurately reflect a company’s financial position. These entries are made at the end of an accounting period to record transactions that have occurred but have not yet been recorded.

Adjustment entries are accounting entries made at the end of an accounting period to record transactions that have occurred but have not yet been recorded. These entries are necessary to ensure that financial statements accurately reflect the company’s financial position and performance. Since the firm is set to release its year-end financial statements in January, an adjusting entry is needed to reflect the accrued interest expense for December. The adjusting entry will debit interest expense and credit interest payable for the amount of interest from Dec. 1 to Dec. 31.

Mistake: Lag in Recording Transactions

In this situation, the accounts thus prepared will not serve any useful purpose. However, in practice, the Trial Balance does not provide true and complete financial information because some transactions must be adjusted to arrive at the true profit. The main objective of maintaining the accounts of a business is to ascertain the net results after a certain period, usually at the end of a trading period.

Similarly, if a company has a liability that has increased in value, an adjustment entry is made to reflect this change. To record an accrual, an accountant would debit an expense account and credit a liability account. In practice, you are more likely to encounter deferrals than accruals in your small business. The most common deferrals are prepaid expenses and unearned revenues. Adjusting journal entries are used to reconcile transactions that have not yet closed, but that straddle accounting periods. These can be either payments or expenses whereby the payment does not occur at the same time as delivery.

Adjusting entries must involve two or more accounts and one of those accounts will be a balance sheet account and the other account will be an income statement account. You must calculate the amounts for the adjusting entries and designate which account will be debited and which will be credited. Once you have completed the adjusting entries in all the appropriate accounts, you must enter them into your company’s general ledger. Accrued revenue is revenue that has been earned but not yet received. To record accrued revenue, an adjusting entry is made to increase the revenue account and increase the corresponding asset account. Accrued expenses are expenses that have been incurred but not yet paid.

Neueste Kommentare